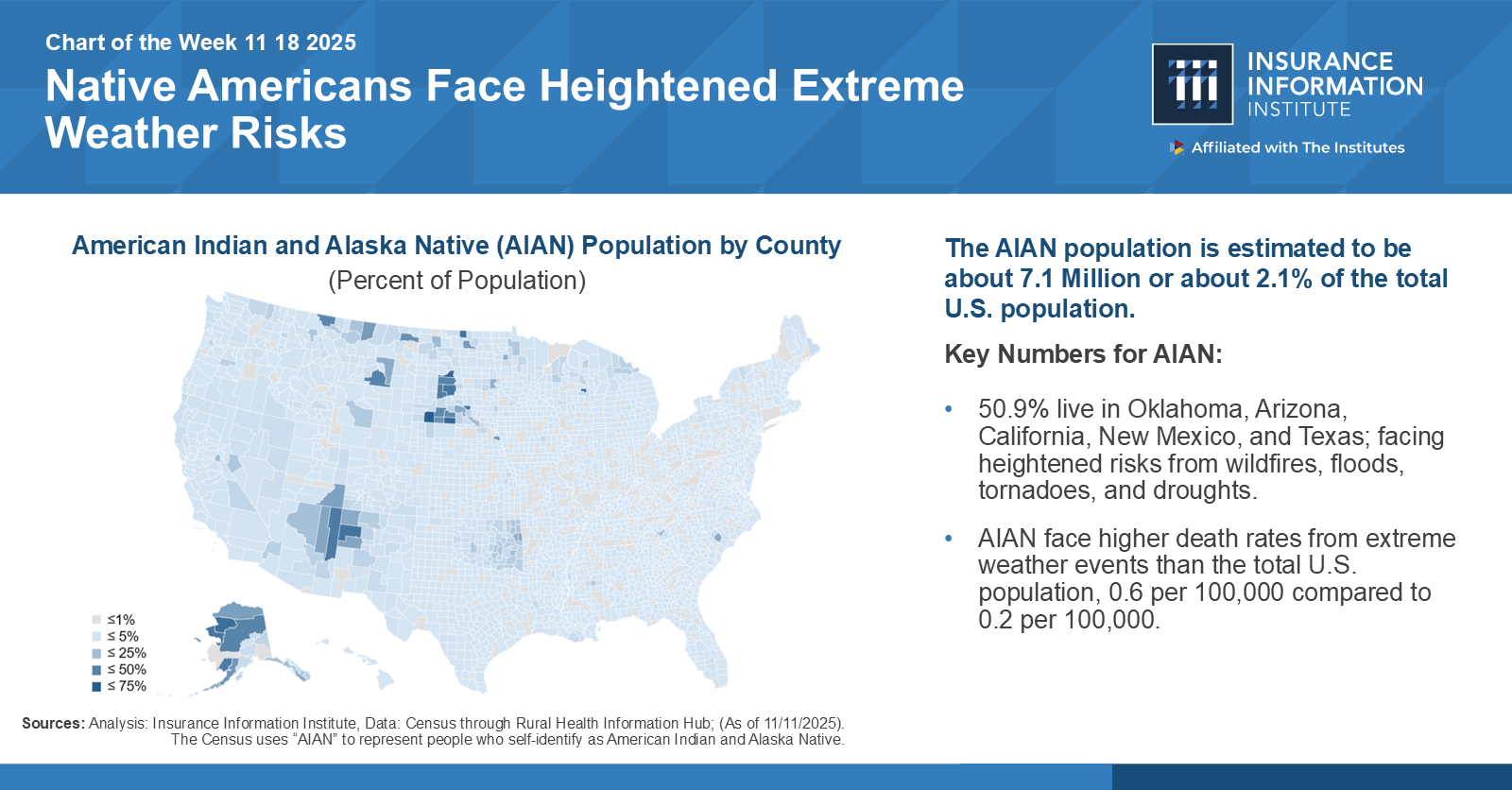

Native People Face Heightened Excessive Climate Dangers

As a part of an ongoing dialogue on the hyperlink between the housing and insurance coverage markets, the Insurance coverage Info Institute (Triple-I) launched a Chart of the Week (COTW) that gives a snapshot of local weather threat considerations for American Indian and Alaska Native (AIAN) inhabitants.

The offered estimate for the variety of Native People within the U.S. is 7.1 million – about 2.1 % of the full inhabitants. As a lot as 95 % of the overall U.S. inhabitants lives in a county that has skilled a pure catastrophe since 2011. Nevertheless, this COTW says not less than 50.9 % of Native People stay in states going through heightened dangers from wildfires, floods, tornadoes, and droughts. The chart additionally reveals that Indigenous folks within the U.S. face greater dying charges from excessive climate occasions than the full nationwide inhabitants, at 0.6 per 100,000 in comparison with 0.2 per 100,000.

Native communities are located on the entrance line of local weather threat.

As insurance coverage is designed to assist policyholders and their communities get well from insurable occasions, protection availability and affordability can contribute to resilience. Nevertheless, states which can be dwelling to not less than half of the U.S. Native American inhabitants rank excessive on the Insurance coverage Analysis Council (IRC) report, Householders Insurance coverage Expenditures as a % of Median Family Revenue – Oklahoma (4th), Arizona (fifth), Texas, (sixth), New Mexico (14th), California (twenty fifth) – indicating comparatively much less protection affordability in these states. Whereas availability and affordability can in the end be pushed by a mixture of key underlying value drivers, local weather threat and home-ownership challenges can play an important position in entry for a lot of Native American owners.

Excessive climate occasions, comparable to hurricanes and typhoons, have formed the way in which colonization of North America unfolded, starting within the early centuries of European contact. For 1000’s of years prior, Native People had thrived of their homelands by taking measures to outlive long-term extreme climate, comparable to seasonally migrating away from flood-prone areas or constructing nature-based infrastructure as wanted. Colonial growth, through which Indigenous folks misplaced practically 99 % of their historic land base over time, decimated Indigenous populations and pushed survivors into high-severe-weather-risk areas or lands, in lots of instances beforehand unknown to their respective tribal teams.

On account of centuries of those compelled elimination insurance policies and government-directed or sanctioned land dispossession, present-day Native American lands “are additionally typically removed from historic lands, averaging a distance of roughly 150 miles” and are sometimes in inherently extra local weather risk-prone areas right this moment – i.e., low-lying, uncovered, much less liveable as a consequence of drought, and so forth. Residing right this moment on the entrance traces of local weather threat throughout the U.S. means steadily experiencing acute results, comparable to thawing permafrost, rising sea ranges, elevated flooding, stronger storms, erosion, and shifting ecosystems.

As an illustration, a 2024 research signifies that Oklahoma, dwelling to 39 federally acknowledged tribal nations, “faces local weather and demographic adjustments that disproportionately put many Native People in danger. The heavy rainfall, 2-year floods, and flash floods are all projected to have elevated dangers by 501.1 %, 632.6 %, and 296.4 %, respectively.”

In a village in western Alaska, the place permafrost is thawing, buildings (together with a preschool) are shifting, water intrusion is growing, and relocation is changing into an actual risk. Not too long ago, practically 50 Alaska Native communities skilled “towering wind speeds, report storm surge, and widespread flooding”, leading to not less than one dying and the displacement of 1,500 folks…Preliminary estimates have reported that the storm decimated 90 % of properties within the coastal village of Kipnuk and 35 % in Kwigillingok, which has additionally skilled poisonous chemical substances spilling into its freshwater provide.”

Local weather threat can threaten lives and property, after all, but in addition regional economies, one of many key components in constructing capability for resilience. For instance, a research of climate-driven financial challenges posed to Navajo Nation, the most important Indian reservation within the U.S., reveals that “drought has a bigger affect on cattle manufacturing than hay manufacturing, leading to complete financial losses of $8.2 million and $0.4 million for the cattle and hay sectors, respectively.” With out sturdy regional economies, infrastructure, or coverage assist, Native American owners and their communities might wrestle to adapt or relocate successfully.

Homeownership prices might contribute to the safety hole.

Native American owners usually tend to lack protection in the event that they:

- Are owners residing in New Mexico and sure rural areas of Texas

- have manufactured properties, or

- personal inherited properties.

Knowledge collected by means of the House Mortgage Disclosure Act (HMDA) reveals that Native People, on common, pay extra to finance their properties – in some contexts as much as two occasions extra. Whereas that disparity could be attributed to a number of elements, one main driver is the mortgage sort that seems to be extra frequent amongst Native debtors, home-only loans. “Almost 40 % of loans to Native American debtors on reservations have been for manufactured properties, in comparison with 3 % of loans to White debtors”. Additional, about 8 out of 10 manufactured-home loans have been home-only loans.

House-only loans, a financing software used for movable private property through which the lender retains possession of the property till the borrower absolutely pays the mortgage, could make monetary sense in some cases. Nonetheless, debtors usually pay greater rates of interest and have fewer client protections, comparable to federal ensures, than common mortgages. The stress of those circumstances might compel the owners to hold inadequate protection, or, once they repay the mortgage, none in any respect.

Federal funding freezes can impede resilience.

Knowledge from the Nationwide Congress of American Indians present that “U.S. residents obtain, on common, about $26 per individual, per 12 months, from the federal authorities, whereas tribal residents obtain roughly $3 per individual, per 12 months.” Latest federal disinvestment in 2025 from essential threat prevention and administration applications and different supportive infrastructure – together with public radio stations which can be utilized for advance extreme climate warnings and coordination of catastrophe restoration efforts – has exacerbated the burden from longstanding disparities. This lower in assist may heighten the necessity for insurance coverage protection and shutting the safety hole.

Amy Cole-Smith, Govt Director for BIIC/ Director of Range at The Institutes says, “the numbers are clear: Native People face greater publicity to excessive climate, greater insurance coverage burdens, and better charges of being uninsured. These elements mirror not simply local weather traits however historic inequities that proceed to form outcomes right this moment. Strengthening protection entry is crucial to defending lives, properties, and cultural continuity.”

As Smith has typically expressed, a technique the business can begin closing the safety hole is “by having folks on the desk who perceive the lived experiences behind the numbers.”

Triple-I works to advance the dialog round essential points within the insurance coverage business. We invite you to comply with our weblog to be taught extra about traits in insurance coverage affordability and availability throughout the property/casualty market.