GlobalData analysis reveals that youthful customers within the UK usually tend to maintain pay-as-you-go (PAYG) or usage-based (UBI) automotive insurance coverage insurance policies. Nonetheless, the newest Client Intelligence Automotive Insurance coverage Worth Index signifies that this group is dealing with rising premiums, with studies suggesting telematics suppliers have gotten much less keen to supply aggressive charges to youthful drivers.

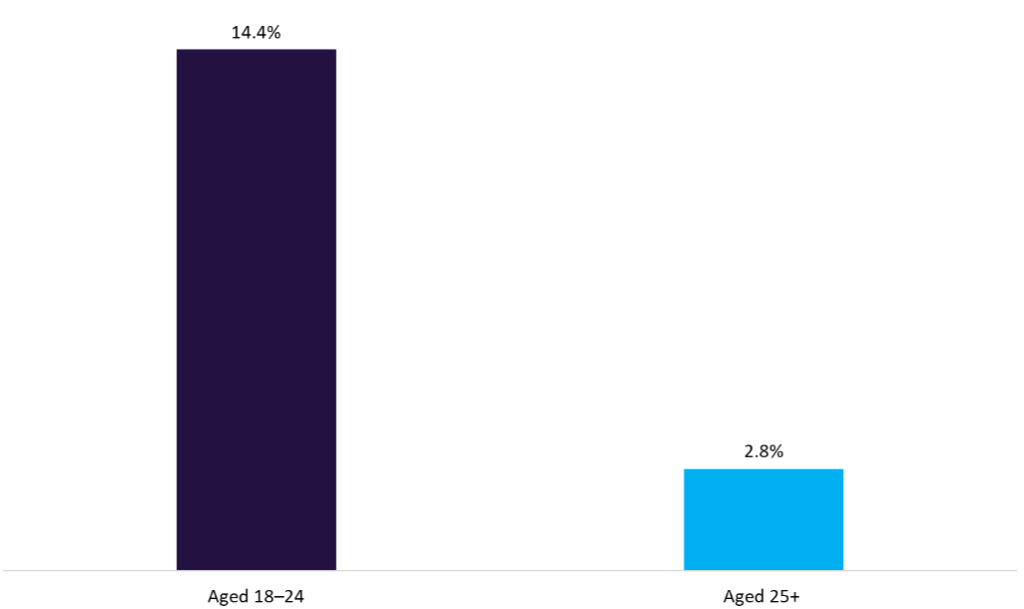

GlobalData’s 2024 UK Insurance coverage Client Survey reveals that 14.4% of customers aged 18 to 24 have a PAYG or UBI automotive insurance coverage coverage. That is considerably increased than the two.8% of customers aged 25 and over. The findings spotlight the stronger enchantment of telematics and versatile insurance coverage fashions amongst youthful drivers, who are usually extra cost-conscious and open to alternate options to conventional insurance policies. In contrast, uptake amongst older customers stays very restricted.

UK drivers with PAYG/UBI automotive insurance coverage insurance policies by age group, 2024

In the meantime, the newest Client Intelligence Automotive Insurance coverage Worth Index reveals that quoted premiums within the UK have fallen by 10.5% over the previous yr. Nonetheless, drivers underneath the age of 25 have skilled the other development, with premiums rising by 3% in Q2 2025, whereas the general market recorded a 1.4% decline. The info highlights that the sharpest will increase are being felt by drivers aged 17 to 19. On the identical time, telematics suppliers that monitor driving behaviour look like displaying much less urge for food for providing aggressive charges to this group.

Regardless of youthful drivers dealing with rising premiums and studies that telematics suppliers are displaying much less curiosity in providing aggressive charges to this group, they continue to be extra doubtless and extra keen to interact with this expertise. Insurers ought to recognise this openness by persevering with to put money into telematics propositions tailor-made to youthful customers. Doing so may help strengthen model loyalty, enhance danger evaluation by means of data-driven insights, and place insurers to seize long-term worth from this phase as their insurance coverage wants evolve.

Total, the findings recommend that youthful drivers stay a key viewers for telematics and UBI. Whereas youthful prospects proceed to face challenges round affordability and restricted competitiveness in pricing, their willingness to undertake new fashions highlights a possibility for insurers to adapt their propositions and construct stronger, long-term relationships with this phase.