A GlobalData survey has discovered that greater than half of UK business brokers imagine cyber insurance coverage is the product that has essentially the most progress potential within the business insurance coverage business. This displays rising consciousness of cyber threats and heightened threat perceptions amongst companies, each of that are driving demand—despite the fact that adoption of cyber cowl shouldn’t be but common.

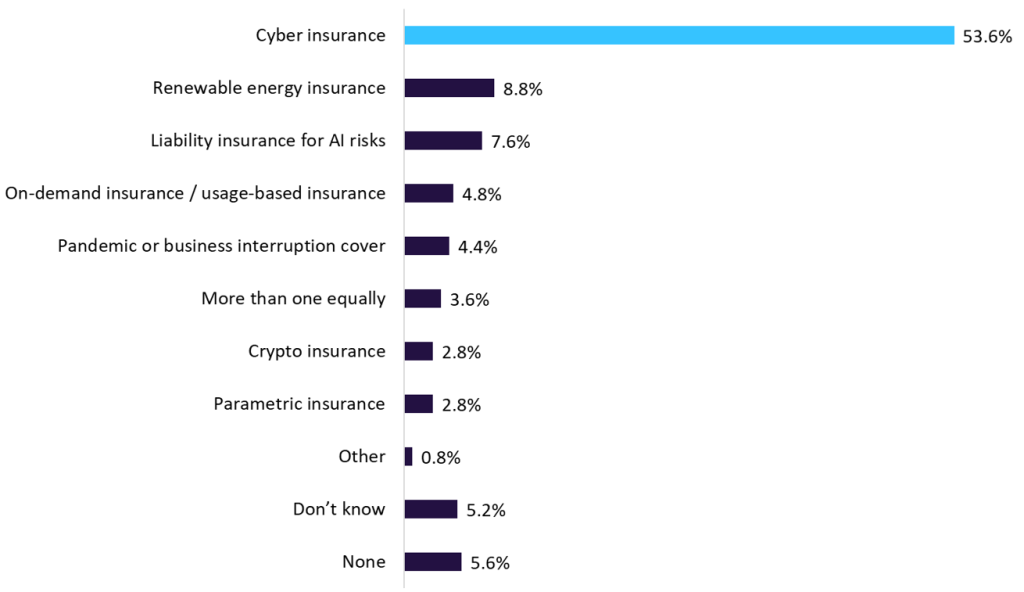

In line with GlobalData’s 2025 UK Business Insurance coverage Dealer Survey, cyber insurance coverage stands out because the product with the best potential for progress. Greater than half of the brokers surveyed (53.6%) chosen it as essentially the most promising rising product, effectively forward of different areas comparable to renewable power insurance coverage (8.8%) and canopy for AI-related liabilities (7.6%). The dimensions of this hole suggests the market sees cyber threats as a key space the place insurance coverage demand will rise sharply. This rising demand is being additional fuelled by heightened consciousness amongst companies and the frequent reporting of cyberattacks within the media.

Which new or rising business insurance coverage product do you see as having essentially the most progress potential? 2025

GlobalData’s findings are backed by latest knowledge from QBE Insurance coverage Group. Its 2024 report confirmed that the variety of cyberattacks greater than doubled in comparison with the 12 months earlier than, rising by 104%. It additionally discovered that a big majority of IT resolution makers (78%) have been anxious concerning the cyber threats dealing with their organisations within the 12 months forward. These findings echo sentiments from brokers and level to a rising sense of urgency amongst companies to strengthen their digital threat administration.

Regardless of this, many companies nonetheless haven’t taken out cyber insurance coverage. Whereas consciousness is clearly growing, this has not but translated into widespread adoption. GlobalData’s 2025 UK SME Insurance coverage Survey discovered that simply 40.2% of small- and medium-sized enterprises (SMEs) have cyber insurance coverage. This hole between concern and motion represents a serious alternative for brokers, significantly within the SME area. Smaller corporations are sometimes extra susceptible to assault however have fewer assets to reply successfully, making them robust candidates for tailor-made cowl.

If uptake is to develop, insurers might want to give attention to making merchandise simpler to know and extra related to several types of companies. There stays confusion round what cyber insurance coverage really covers, particularly relating to conditions comparable to downtime, knowledge breaches, and regulatory penalties. Constructing clearer insurance policies and providing easy recommendation may very well be key to serving to extra corporations really feel assured in taking out safety.