Following the “paradigm-shifting” Los Angeles wildfires in January, the 2024-2025 wildfire season shall be remembered as a turning level for the insurance coverage business, and a warning that “wildfire is now not a seasonal or rural phenomenon, a brand new outlook asserts.

The remainder of 2025 poses extreme wildfire danger in quite a few states because of creating drought circumstances, together with excessive danger in wildfire-prone California, in response to a report from ZeztyAI.

The L.A. wildfires killed 29 folks, and broken or destroyed 1000’s of properties. The fallout of the fires included giant losses for main California insurers, together with State Farm. The provider is asking the California Division of Insurance coverage to approve a big charge enhance. In response to the California Division of Insurance coverage, 37,749 claims have been filed associated to the fires and $12.1 billion has been paid out.

Nonetheless, the wildfire perils weren’t solely in California.

Associated: Householders Suing USAA and AAA Insurers Over LA Wildfires

“From New Mexico, the place one of many state’s most damaging wildfires validated early high-risk forecasts, to blazes within the Midwest and Southeast, the 2024 season revealed wildfire’s increasing geographic footprint, relentless tempo, and more and more unpredictable habits,” the report said. “For insurance coverage carriers, it uncovered the bounds of legacy fashions nonetheless tied to historic fireplace perimeters or broad geographic zones, and accelerated adoption of next-generation instruments that assess parcel-level vulnerability—together with structural options, defensible house, and vegetation overhang.”

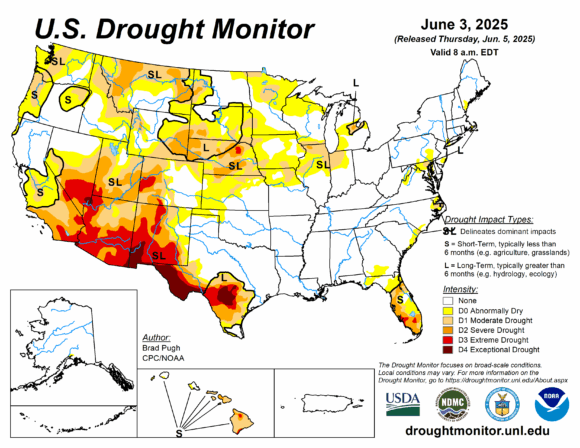

The remainder of the 12 months is shaping as much as be extra risky following a average 2024 wildfire season. Extreme drought circumstances are anticipated to return and unfold throughout the nation, with intensified dryness within the Southwest and deep into the Northern Rockies and the Plains, in response to the report.

“Heavy rains in California, Oregon, and Washington throughout the previous two years have pushed vital vegetation development. If warmth and dryness persist into late summer time as forecasted, these areas may as soon as once more grow to be extremely flamable,” the report states. “This acquainted sample, the place moist years increase gasoline masses that flip harmful when circumstances shift, stays a long-term driver of wildfire danger in these traditionally weak states.”

Associated: Invoice to Deal with California Wildfire And Insurance coverage Crises Transferring Via Legislature

The report notes that states like Arizona, New Mexico, Nevada, Utah, and Colorado stay in multi-year droughts, whereas Montana, Wyoming, North Dakota, and South Dakota are rising as new high-risk zones as a result of a dry, snow-starved winter and unusually heat spring. Drought indicators are additionally popping out of Texas and Florida, in response to the report.

The report additionally touches on how new state guidelines and legal guidelines are reshaping how insurers are assessing and speaking danger:

- In late 2024, the California Division of Insurance coverage finalized its Sustainable Insurance coverage Technique, a reform to stabilize the state’s insurance coverage market. Central to the technique is the approval of forward-looking disaster fashions in charge filings—permitting insurers to cost wildfire danger primarily based on future publicity reasonably than previous losses.

- In 2025, Colorado enacted Home Invoice 25-1182, establishing a brand new benchmark for transparency in wildfire danger modeling. The legislation applies to all admitted carriers and the FAIR Plan. It requires insurers to reveal how wildfire fashions influence charges, acknowledge each property- and community-level mitigation efforts, notify policyholders yearly of their danger scores and reductions and supply an appeals course of for disputed scores.

- In 2024, Washington adopted new rules geared toward bettering transparency round insurance coverage premium will increase. Insurers are required to inform policyholders that they could request a written clarification for any enhance of their owners or auto insurance coverage premiums. Upon request, carriers should present a rationale inside 20 days.

- In April, Oregon handed Senate Invoice 83, repealing the state’s necessary wildfire hazard map following sustained public opposition. The unique map had labeled properties into danger zones that triggered defensible house necessities and stricter constructing codes—measures that some property house owners argued had been primarily based on incomplete or inaccurate information and had unintended penalties on insurance coverage availability and property values.

Matters

Disaster

Pure Disasters

Wildfire

Louisiana

Considering Disaster?

Get automated alerts for this matter.