World insured losses from pure catastrophes hit US$137 billion in 2024, following the 5%-7% annual development charge that has been the norm in recent times, in response to Swiss Re evaluation.

If this development continues, world insured losses will strategy US$145 billion in 2025, primarily pushed by secondary perils corresponding to extreme convective storms (SCS), floods and wildfires, stated the Swiss Re sigma report titled “Pure catastrophes: insured losses on development to USD 145 billion in 2025.”

Whereas loss severity for nat cats is rising globally, North America accounted for nearly 80% of world insured losses in 2024, because of the area’s publicity to extreme thunderstorms, hurricanes, floods, wildfires, and earthquakes, the report stated. (Editor’s observe: the 80% determine will be discovered on web page 29 of the principle report, desk 3).

“After a number of years of underwriting losses, householders’ premiums solely not too long ago caught up with housing substitute prices. Nevertheless, ongoing underwriting losses counsel that premiums are nonetheless not commensurate with the chance, and that additional alignment is critical to maintain insurance coverage enterprise.”

“As has been the case in recent times, in 2024 many of the world insured losses had been pushed by secondary perils, particularly extreme convective storms within the US,” Swiss Re stated, noting, that the lethal fires in Los Angeles in January this 12 months level to a different 12 months of excessive losses from secondary perils.

World financial losses from catastrophes had been US$318 billion, the best since 2017 (US$448 billion in 2024 costs). “Round 43% had been coated by insurance coverage, highlighting the continued existence of enormous safety gaps in lots of components of the world, together with in superior economies,” the report stated. The 2024 insurance coverage safety hole of $181 billion — up from $177 billion in 2023 — is the distinction between total financial losses and the quantity coated by insurers.

Peak-Loss Years

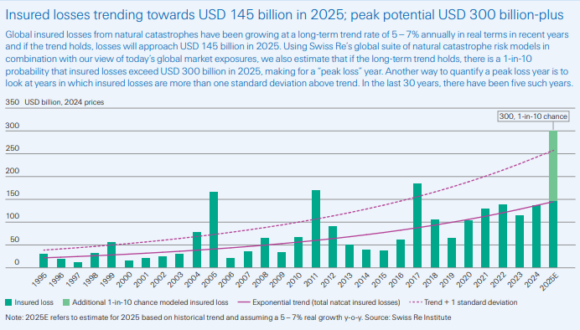

Regardless of the excessive price ticket from secondary perils, Swiss Re warned, it’s major perils (tropical cyclones and earthquakes) that stay the most important contributor to insured losses total. Swiss Re pointed to the 5 so-called “peak loss” years which have occurred within the final 30 years (1999, 2004, 2005, 2011 and 2017), when annual losses had been means above development.

In 2017 – the final peak-loss 12 months – Hurricanes Harvey, Irma and Maria drove world insurance coverage losses to 111% above development, however Swiss Re warned that the following interval of quiet since then didn’t gradual the underlying development of danger.

Swiss Re’s pure disaster fashions level to a 1-in-10 likelihood that world insured losses may attain as excessive as US$300 billion in 2025, creating subsequent peak-loss 12 months. (See above graphic).

Swiss Re cautioned that peak loss years, “attributable to both the buildup of many loss occasions or these from just a few particular person giant occasions, shouldn’t be thought of a freak prevalence.” “Historical past repeats, and it’s not a query of if, however when the insurance coverage business will face the subsequent peak loss 12 months.”

Los Angeles Wildfires

Though 2025 started with document insured wildfire losses of roughly $40 billion in Los Angeles, Swiss Re defined that the fires on their very own won’t trigger a notable deviation from the annual loss development development for pure catastrophes (of 5%-7%).

“Of the full losses, insurance coverage claims for residential property had been at the least US$30 billion,” stated Swiss Re, estimating it will doubtless generate a loss ratio of round 200% for householders’ insurers in California.

“Assuming an round 50% base load, the loss ratio is heading in direction of 250%. The final time the loss ratio was of comparable magnitude was in 2017 (201%) and 2018 (176%), when wildfires in California triggered document losses for that point,” the report added.

“We estimate that two-thirds of payouts to cowl the fireplace losses will come from major insurers, one-third to be paid by reinsurers. The dimensions of losses was so giant that many excess-of-loss reinsurance covers had been triggered. The reinsurance share of loss would have elevated additional with an excellent greater loss.”

In years when losses are near development, Swiss Re stated, major insurers cowl the vast majority of property claims, however when main disasters strike and losses rise nicely above development, “reinsurers step in to cowl greater than half of the losses in extra of development.”

Householders Insurance coverage

Householders in catastrophe-prone states are feeling the ache of rising premiums, as their insurers search to return to underwriting profitability.

Within the US, householders’ insurers have seen their web incurred losses improve by 8% yearly since 2018 – a development pushed by a post-COVID surge in development and claims prices. “The consequence of the latter is that home-owner insurers have seen a number of years of underwriting losses,” Swiss Re stated.

“After a number of years of underwriting losses, householders’ premiums solely not too long ago caught up with housing substitute prices. Nevertheless, ongoing underwriting losses counsel that premiums are nonetheless not commensurate with the chance, and that additional alignment is critical to maintain insurance coverage enterprise.”

The states with highest exposures to pure catastrophes are additionally these the place, generally, home-owner premiums are highest, the report stated, pointing to 5 states – Florida, Texas, California, Louisiana and Colorado – which account for round 50% of all pure disaster losses within the U.S.

“Traditionally, Louisiana has suffered the best pure disaster losses per coverage, adopted by Florida. These have principally been on account of losses emanating from hurricane occasions,” the report confirmed.

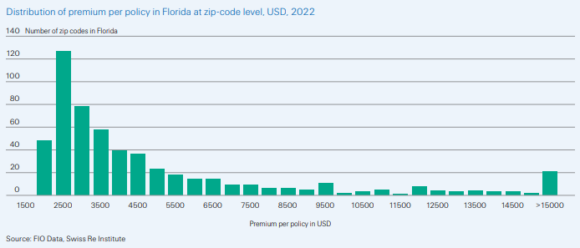

“House owner premiums per family within the state of Florida are twice the nationwide common,” the report stated, noting that in states with greater common premiums (corresponding to Florida), extraordinarily excessive premium ranges are localized.

For instance, in 11% of the Florida’s zip codes, premiums per coverage had been above US$10,000, the report stated. “These are usually coastal zip codes with highest danger of storm surge and/or wind injury.”

{Photograph}: A home lies toppled off its stilts after the passage of Hurricane Milton, in Bradenton Seashore on Anna Maria Island, Fla., Oct. 10, 2024. (AP Photograph/Rebecca Blackwell, File)

Associated:

Subjects

Developments

Revenue Loss

Claims