California Insurance coverage Commissioner Ricardo Lara provisionally accredited State Farm’s request for a 22% interim owners insurance coverage fee hike, the California Division of Insurance coverage introduced on Friday.

The approval depends upon whether or not the corporate can justify the speed enhance with information throughout a public listening to scheduled for April 8.

In an announcement, State Farm stated, “It’s time for certainty within the California insurance coverage marketplace for our clients. The provisional nature of immediately’s resolution doesn’t enhance that certainty however it’s a step in the correct path. We’re transferring ahead with implementing this provisionally accredited fee and can proceed to work with the California Division of Insurance coverage for a sustainable future for the California insurance coverage market.”

“State Farm Basic has labored brazenly and actually with all events on this course of,” the service continued. “As well as, State Farm Basic will proceed to observe capability to assist its dangers and construct enough capital for the longer term.”

Lara this week additionally referred to as on State Farm to halt non-renewals and pursue a $500 million capital infusion from its mother or father firm to revive monetary stability. He introduced this proposal throughout a gathering with State Farm representatives, CDI, and an intervenor.

State Farm’s fee will increase – in the event that they stand – can be efficient June 1, and embody 22% for owners, 15% for renters, 15% for condominium, and 38% for rental dwelling. State Farm in Could 2023 stopped writing new insurance policies in California and non-renewed hundreds of current insurance policies.

Lara in mid-February opted to not approve the speed request from State Farm, as an alternative calling a gathering with the service to get some solutions about its monetary state of affairs.

Bloomington, Illinois-based State Farm stated on the time of its request that the will increase are wanted to align value and danger, and allow State Farm to rebuild capital. During the last 9 years, the dearth of alignment has meant that for each $1 collected in premium, the service has spent $1.26, leading to extra $5 billion in cumulative underwriting losses, based on State Farm.

Forward of immediately’s resolution, firm executives and representatives of the buyer group Shopper Watchdog pled their opposing instances in letters to Lara.

Throughout a Feb. 26 assembly, State Farm knowledgeable the commissioner that whereas it might probably cowl claims from L.A. wildfires, the catastrophe worsened its monetary situation. The Golden State’s prime owners insurer partly blamed the devastating Los Angeles wildfires for its fee request. As of February 14, the service reported roughly 11,400 whole dwelling and auto claims, paying out greater than $1.35 billion.

Insurance coverage corporations have thus far paid out greater than $12 billion for losses from the 2 largest L.A.-area wildfires that swept by means of the area and destroyed tens of hundreds of houses in January.

“To resolve this matter, I’m ordering State Farm to reply to questions in an official listening to, selling transparency and a path ahead,” Lara said. “It’s evident that different California insurers are unable to soak up State Farm’s current clients, which poses a big danger of those clients ending up on the FAIR Plan—a state of affairs all of us want to keep away from as my Sustainable Insurance coverage Technique is carried out.”

Shopper Watchdog responded to the commissioner’s resolution, noting that it’s provisional, and never an precise approval.

“The commissioner referred to as a listening to as Shopper Watchdog has been urging since State Farm made its unprecedented request for a $900 million ’emergency’ fee hike,” Shopper Watchdog stated in an announcement. “It’s a victory for customers that State Farm should make its case in a public listening to earlier than a decide, and the decide will resolve if a fee hike is justified. The corporate has thus far did not again up its request, and until State Farm proves in any other case the end result of a listening to ought to be a rejection.”

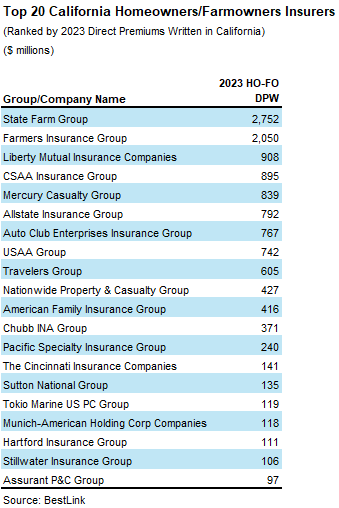

State Farm is the state’s largest owners insurer. Following State Farm, the state’s largest owners insurers are Farmers Insurance coverage Group, Liberty Mutual Insurance coverage Corporations, CSAA Insurance coverage Group, Mercury Insurance coverage Group, Allstate Insurance coverage Group, Auto Membership Enterprises, USAA Group, and Vacationers.

Matters

California

An important insurance coverage information,in your inbox each enterprise day.

Get the insurance coverage trade’s trusted e-newsletter