Having a Certificates of Insurance coverage is important as a enterprise proprietor.

However what’s a COI (and the way do you learn it)?

In case you are a small enterprise proprietor, you’re most likely conscious that you simply want a Certificates of Insurance coverage (COI).

You may need been requested to offer one by a savvy client or potential landlord. Or maybe your impartial insurance coverage agent suggested that you’ve got one.

Or chances are you’ll not have the slightest clue what it’s.

As Central Florida-based impartial insurance coverage brokers, we not solely know what a Certificates of Insurance coverage is, however we’re additionally used to answering questions on them. Let’s reply a few of your prime questions on your Certificates of Insurance coverage.

In case you’ve ever puzzled “What’s a COI?” or “What do all these numbers and letters imply?” enable us to shed some gentle on this essential doc.

What’s a COI?

A Certificates of Insurance coverage (COI) is a doc that serves as proof of enterprise insurance coverage protection. It’s also referred to as a Certificates of Legal responsibility Insurance coverage, or proof of insurance coverage protection.

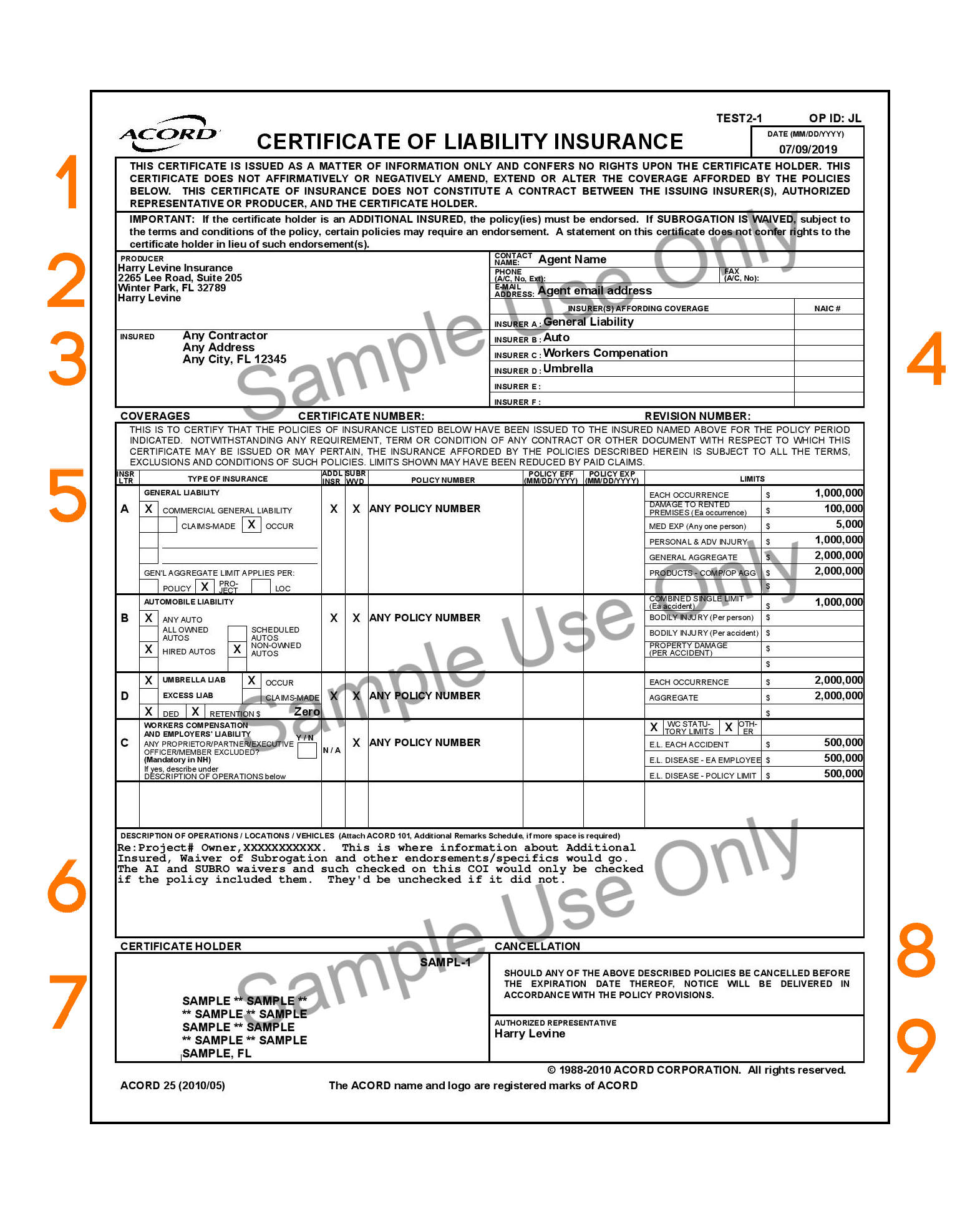

Issued by your insurance coverage supplier, your COI gives a snapshot of your coverage on the time it was issued, detailing protection sorts, limits, and policyholder info. Whereas not an precise coverage, a COI is a standardized doc—usually primarily based on ACORD templates—used to display protection to shoppers, distributors, or regulatory authorities.

As a enterprise proprietor or impartial contractor, you’ll be able to request a COI for a number of varieties of enterprise insurance coverage—basic legal responsibility insurance coverage, enterprise insurance coverage, auto insurance coverage, and extra.

Why You Want a Certificates of Insurance coverage

So in case your COI is just not your coverage, why do you want a certificates in any respect?

When a consumer requests a COI, they’re asking for validation that your online business is correctly insured. Your Certificates of Insurance coverage acts like a letter of advice out of your insurance coverage firm—full with its stamp of approval. As a small enterprise proprietor, it exhibits potential shoppers that you’ve got the correct insurance coverage protection, and it gives monetary safety within the case of an incident along with your consumer.

With out it, any shady contractor might lie about having basic legal responsibility protection to keep away from paying hefty premiums. As you would possibly guess, this might get extraordinarily messy within the occasion they trigger harm or property injury.

Find out how to Learn Your Certificates of Insurance coverage

There’s numerous info included in your COI, however it’s not as difficult to decipher as it could appear. Your Certificates of Insurance coverage will be damaged down into 9 essential sections and every of those sections has a special, but essential, objective.

1. Disclaimer

The disclaimer states that the Certificates of Insurance coverage is merely a illustration of your present protection and doesn’t “amend, lengthen, or alter” your insurance policies.

2. Producer

This part will listing the title and deal with of the insurance coverage agent or dealer who issued your COI.

3. Insured

The authorized title and deal with of the individual or firm lined below the insurance coverage insurance policies described on the COI.

4. Insurers Affording Protection

This part will listing the entire insurance coverage corporations that the Insured has insurance policies below. They’re listed A by way of F.

5. Coverages

Your “Coverages” part is the longest, as that is the place you will discover the entire particulars of your online business insurance coverage protection, together with insurance coverage kind, efficient dates, and limits. This space is the place COIs are inclined to get a bit of complicated, so let’s break it down.

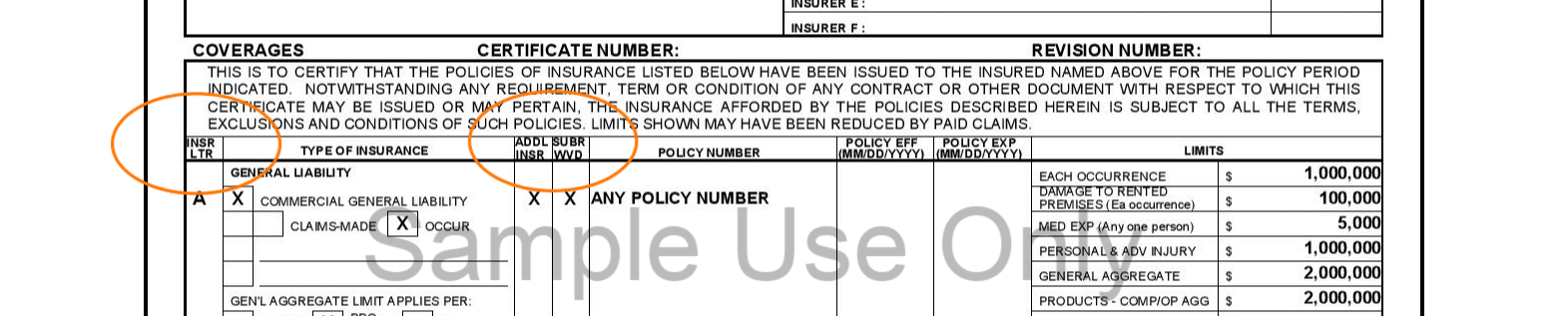

On the far proper, you’ll see a column labeled “INSR LTR.” That is quick for “Insurer Letter”; the letter you see right here will correspond to the Insurer Affording Protection as described earlier.

For example, if there’s a “B” on this column, it implies that the insurance coverage firm holding that specific coverage is identical insurance coverage firm listed subsequent to “B” within the “Insurers Affording Protection” part.

“Sort of Insurance coverage” refers to the kind of protection afforded by coverage, whether or not safety towards legal responsibility, auto or fleet protection, storage, extra, or employees compensation, and extra.

Subsequent you’ll see two columns labeled “ADD’L INSRD” and “SUBR WVD.” The primary one stands for “Extra Insured,” and an X positioned on this column signifies that the individual being issued the Certificates is a further insured on the coverage.

“SUBR WVD” stands for “Subrogation Waived” and is a really essential a part of your Certificates of Insurance coverage, particularly if you’re offering this doc as a subcontractor. If the SUBR WVD field is checked off, that implies that the insurance coverage firm of the named insured will be unable to pursue authorized motion towards specified events that often embrace the Certificates Holder (see #7 above) within the occasion of a declare, even when they had been instantly chargeable for the damages.

Subsequent listed is the suitable coverage quantity, in addition to the efficient and expiration dates of the coverage. The final column exhibits the boundaries (in {dollars}).

6. Description of Operations

If there are any particular operations, areas, or initiatives that the Certificates of Insurance coverage applies to, they are going to be listed right here. That is additionally the place the COI would listing details about any Extra Insured or Subrogation Waiver.

7. Certificates Holder

The title and deal with of whoever is requesting the Certificates of Insurance coverage. In some circumstances, this can be the enterprise itself; in different circumstances, it could be their consumer or one other establishment.

8. Cancellation

That is one other disclaimer that lists the variety of days that the insurance coverage firm will ship discover to the Certificates Holder within the occasion that any of the insurance policies are canceled earlier than the expiration date listed. Thirty days is commonplace.

9. Licensed Consultant

Your Certificates of Insurance coverage should embrace the signature of your insurance coverage agent/dealer or a consultant of the company.

For extra info on insurance coverage phrases you could know, test our information right here.

Get Your Certificates of Insurance coverage

Understanding your Certificates of Insurance coverage is a crucial a part of proudly owning a small enterprise, but when your insurance coverage agent is simply telling you which of them coverages you presently have, you’re solely seeing a small piece of the puzzle.

Accidents, shoddy work, negligence, and different claims happen on a regular basis in business settings, which is why it’s essential to have the fitting stage of insurance coverage to guard your online business.

At Harry Levine Insurance coverage, we’ve been assembly Central Florida’s insurance coverage wants for greater than 30 years, and we now have the data, sources, and experience to establish and shut gaps in your protection.

In case you’re searching for inexpensive protection that meets your wants, request a quote at this time.